What To Sell On Amazon EU

Finding Profitable Products To Sell On Amazon EU

This article presents the 4 step methodology I use to evaluate a product’s potential on Amazon EU, including 2 real-life examples.

You may already know that Amazon Europe (EU) comprises 5 key marketplaces - the UK, Germany, France, Italy and Spain.

While the UK and Germany clearly offer the largest amount of customers, some sellers can find that other markets are more successful, due to lower competition (fewer sellers).

As such, we recommend you consider a product's potential in each of these 5 marketplaces.

The following is a framework to assess the potential of a product on Amazon EU.

1. Sales potential

Successful Amazon FBA businesses are driven by sales and so, that’s where we will start.

The question we seek to answer is this - how many units can I expect to sell in Europe, based on the performance of similar products there?

Helpful Tools

There are a number of tools available to estimate and track the sales of products on Amazon Europe, including Jungle Scout, AMZ Tracker, Sellics and AMZ Shark.

My favorite of these is Jungle Scout and it’s the tool I use to do product research. It allows you to quickly estimate sales across niches and also neatly presents the other key data you need to consider, including pricing and reviews.

If you don’t have access to tools like this, you can use free keyword tools like Google Keyword Planner to identify the search volume for your products in Europe.

Although not specifically offering sales data, they can provide an indication of sales e.g. low search volume on Google UK for a specific keyword, suggests low sales in the UK.

If it’s clear there is a lack of sales of a product type throughout Europe, it’s best to move on and assess the potential of another product.

However, with 5 marketplaces and much lower competition than the US, you will often find the landscape in Europe is an attractive one for your products.

What if your product is unique and will be the first of its type to be sold on Amazon Europe?

In this case, we have a high risk high reward scenario.

Without knowing the sales of similar products, we have no idea how well our product will sell in a new market, which is why it represents a higher risk - although, this risk can be offset by sending a smaller quantity of inventory to Europe as a way to test to the market. With no direct competitors, the potential is also significant.

Assuming we deem there is sufficient sales in Europe for a product, we must next determine the level of competition in this niche.

2. Competition

Just as we did with sales potential, we must analyze competition across each of the 5 marketplaces.

I recommend you rate competition in each marketplace e.g. using a scale from 1 to 5 - 1 being lowest competition, 5 being the highest. This will provide an easy way of comparing the opportunities available to you.

If you are selling generic private label products, with little to no differentiating factors, the risk will be higher - there is nothing to prevent new sellers imitating your product and eroding market share in the future.

Here are some of the key factors to consider when evaluating competition in a new market:

- How many competitors are there selling products similar to yours? The fewer the better generally, although if there are none, it may suggest lack of demand for your product type.

- Do the top selling products in your niche have a large number of reviews, that may make them difficult to outrank? This is generally not the case in Europe, unlike on Amazon.com.

- How does the quality of your product compare to those being sold in this marketplace? You can evaluate this by looking at the images of the competition on Amazon, but also by checking out the average review rating for the top sellers. For example, if there are sellers with a less than 4 star average rating and selling a lot of units, this will be encouraging - assuming you have a high quality product right :)

- What is the quality of your potential competitors' product listings? If there are sellers with poor quality listings that are still selling well, this is a good indicator that we can do well in this market. On a positive note, the quality of listings in Europe is generally much lower than we see on Amazon.com. Even if you don't speak the language and can’t assess the quality of the sales copy used, here are some factors that indicate lower quality listings:

- Poor quality images

- Less than 5 images used in the listing

- Very short product title

- Very short or no product description

- Fewer than the allowed 5 bullet points

Let’s assume you’re considering the potential of 2 products in Europe.

Having looked at sales potential and competition, your evaluation / research would look something like this:

In this example, despite its lower estimated daily sales (14 units), Product A appears to be more attractive due to its lower competition.

However, there are other key pieces of the puzzle, before we can make a final decision. The next one is pricing.

3. Pricing

It’s also critical to determine the price range at which we are likely to sell in a new marketplace. This will allow us to calculate how profitable our product will be in a new marketplace.

Here are some key factors to consider with respect to pricing:

- What is the price range of the top sellers? For example, if we see all of the top sellers are lower priced, this will suggest a more price sensitive niche.

- Based on the quality of your product compared to your potential competitors, what is the likely price at which you will sell? If we have a superior offering, this should allow us to price at a premium.

- You may need to price a little lower at the start in order to gain market share. Customers on Amazon tend to prefer buying products that have social proof (more reviews), so a lower price can incentivize buyers to check out your offering, as you seek to organically build your reviews.

- On Amazon Germany, France, Italy and Spain, sales are made in Euro (€), while in Amazon UK, sales are made in GBP (£).

4. Profitability analysis

Once we have established our likely sales price, the next step is to calculate profitability. We must know there is sufficient profit to be earned, before we invest our time and money.

We do this by estimating all costs to sell our product in Europe, including:

- Manufacturing costs

- Importing / shipping to Europe

- Product labelling

- Amazon Europe’s referral and fulfillment fees - broken down nicely here

- Product listing optimization / translation

- Advertising / PPC spend

- Software used to run your business e.g. email automation to customers

- Staff support e.g. for customer service and PPC

- Taxes / VAT

Once we have estimated pricing and costs, we can then calculate the profit margin of our product(s) in Europe. Amazon's Profitability Calculator can help speed this up.

Now, let’s finish off our example, where we have added the profit per unit and estimated daily profit for products A and B.

Decision time

The question now is which opportunity is more attractive.

Product A has lower competition and similar sales (in units) to Product B. However, Product B is expected to be a much more profitable product, with an estimated €38 extra profit per day (33% more than Product A).

If you could only pick one, which would you choose?

The answer will depend on your risk appetite. Product B offers higher risk, but higher reward. Product A is lower risk, but has lower expected profit.

In general, when expanding to a new marketplace, I would recommend going with the lower competition / risk product. Once you have gained traction and learned the ropes in that marketplace, you can then begin to pursue higher risk opportunities (if you want) from a better position - both in terms of cashflow and experience.

If you have a competitor in your domestic market who has expanded to Europe, you can also review how they have done. If you see, for example, they are selling just 3 of their top 5 products in Europe, this may indicate there is insufficient demand and / or too much competition for the other 2 product types.

Reviewing the performance of a competitor is unlikely to provide all the answers, but it can certainly be a nice compliment to other research you do.

Product Research For Amazon Europe (Examples)

One of the issues with articles that offer advice like this is that they are too theoretical and don't highlight real life examples. To avoid this, let's look at two real life examples.

Product research - Example A

Keyword - RFID Wallet

Marketplace - Amazon UK

In this first example, we are selling a RFID Wallet on Amazon.com and want to know the potential for this product on Amazon Europe.

To start, we want to look at the potential offered by Amazon UK.

The data below derived using Jungle Scout displays key data from the top search results on Amazon UK for the term “RFID Wallet” (August 2017).

Does the UK look like an attractive market for this product?

I think so. And I’ll tell you why.

With an average of 391 units sold per month for the top listings displayed, that’s about 13 per product per day. This is excellent, particularly as 10 sales per day is seen as a benchmark for a successful Amazon FBA product.

Sales depth is also good and appears to be nicely spread out amongst the listings. There are 7 products selling more than 9 per day (270 per month).

The average sales price (£14.35) is a little lower than many experts would recommend - however, it doesn’t concern me in this case as customers in this market don’t appear to be price sensitive. 3 of the top 5 sellers are priced above the average market price - this suggest customers are willing to pay for a premium / higher-priced product.

Furthermore, there are no major brands in this market to compete against.

Finally, products with fewer reviews can outsell those with more reviews in this market. This is particularly interesting for a new entrant, as it will take some time to build up our reviews.

Overall, there is strong potential here and it warrants further analysis, including an evaluation of the potential profitability, and a more in-depth look at the competition and their listings.

Now, let’s go through another example.

Product research - Example A

Keyword - Garlic Press

Marketplace - Amazon UK

In this next example, we are selling a garlic press on Amazon.com and we are looking to assess the potential for us on Amazon UK.

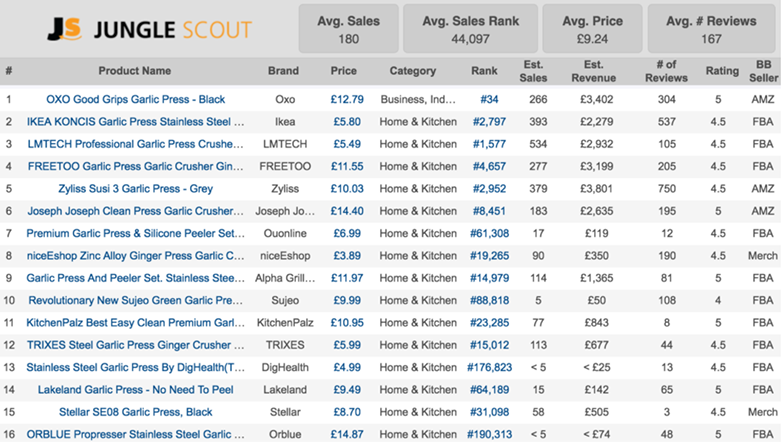

The analysis below (from Jungle Scout) shows the top results for the search term “garlic press” on Amazon UK ( (August 2017).

Should we sell our garlic press on Amazon UK?

At first glance, we see there is an average of 180 units sold per month for these top listings. That’s 6 units per day per product. Not bad, particularly when you factor in that there are also 4 other marketplaces in Europe to evaluate (Germany, France, Italy and Spain).

However, there is a noticeable lack of depth in the UK market. The top 6 listings account for over 70% of the units sold. I also see 2 FBA Sellers (ranked 14 and 16) with very poor sales, despite a solid number of product reviews and a 5 star average review rating!

There are other factors that lead me to believe potential here is limited:

- The top 2 sellers are big brands (Oxo and Ikea) and will likely be very difficult to compete against.

- The top 5 sellers all have over 250 reviews, which is a significant number in the UK market.

- We will be competing against high quality products - 15 of the top 16 listings having an average review score of 4.5 or 5 stars.

Next Steps

I hope the methodology and tips provided here can help you find profitable products to sell on Amazon EU.

If you have any questions, just leave a comment below. Please share this post if you like it too!

Not yet selling on Amazon EU? Check out our all-in-one service that helps sellers successfully launch on Amazon EU. It covers everything you’ll need, including translations and VAT!

Want more content like this? Sign up to our mailing list below!

Grow and succeed on Amazon

Tips and insights to help you grow your Amazon business in US & Europe

Grow and succeed on Amazon

Tips and insights to help you grow your Amazon business in US & Europe